How Conversational AI Can Build Financial Confidence for Women - Lessons from MyHisaab

Artificial Intelligence is often presented as a revolutionary force for efficiency and scale. But without intention, it risks reinforcing existing inequalities - especially for populations already excluded from formal systems. For women in Pakistan, AI can either widen the gap or quietly bridge it.

The promise of AI lies not in automation alone, but in its ability to reduce cognitive and emotional friction. Financial management is not just a technical task; it is deeply emotional. Fear of making mistakes, embarrassment about lack of knowledge, and anxiety around money prevent many women from engaging at all.

This is where conversational AI becomes powerful.

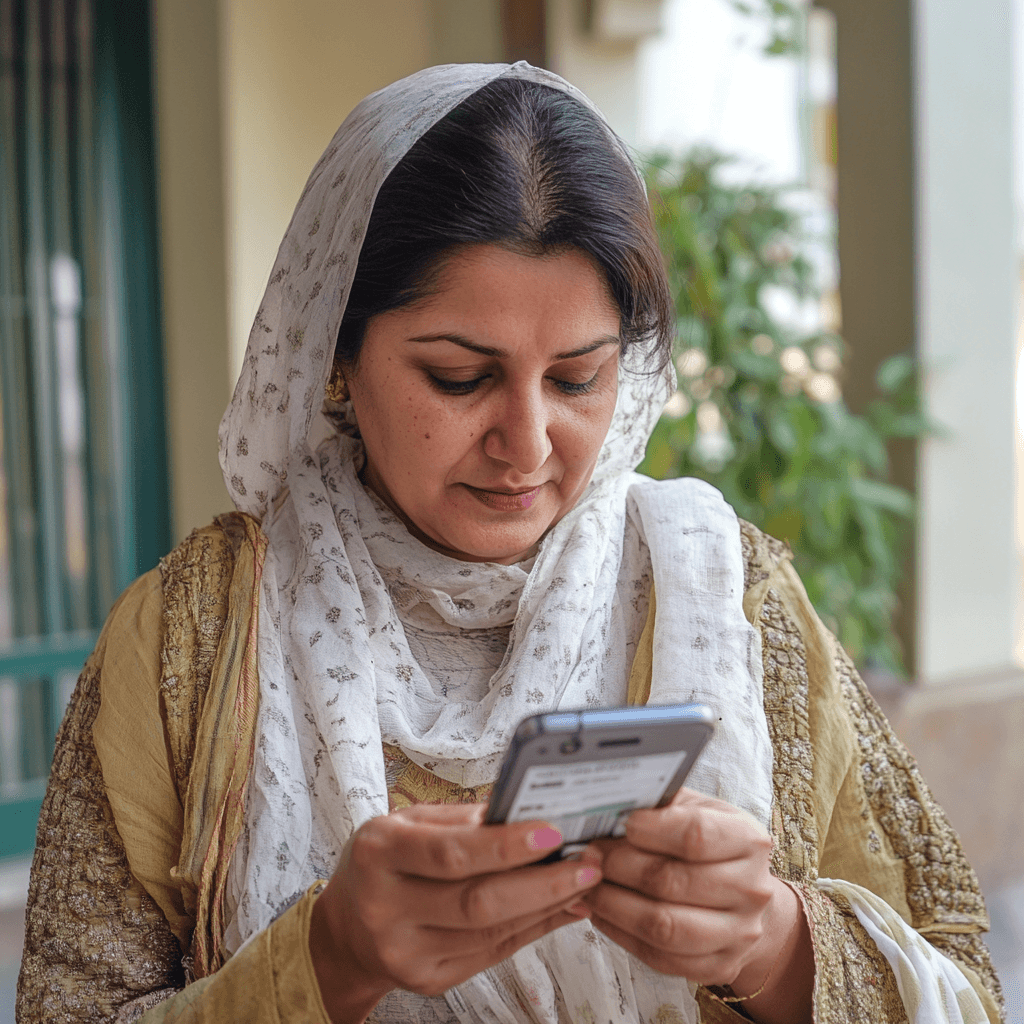

MyHisaab was designed around a simple insight: women already know how to chat. WhatsApp is familiar, trusted, and woven into daily life. By embedding AI into a conversational interface, MyHisaab removes many of the invisible barriers that traditional fintech products impose.

There is no app to download, no complicated onboarding, and no formal financial language to decode. Women can log expenses, ask questions, or request summaries using natural language - in Urdu, Roman Urdu, or English. They can even send photos of receipts. The system adapts to them, not the other way around.

Early usage data confirms that the approach works. Tens of thousands of users engaged with the product, many showing early habit formation and willingness to pay - even in small amounts - for clarity and control. Yet the data also revealed a critical challenge: despite being designed for women, only a small percentage of users were female.

This gap highlights an essential lesson. Designing for women is necessary, but not sufficient. Trust plays a decisive role. Women are more cautious when adopting digital tools, especially those related to money. Household dynamics, fear of scams, lack of guidance, and limited phone ownership all influence adoption.

Behavioral insights further show that women engage differently. They send richer, more detailed messages and often bundle multiple instructions into a single interaction. They expect empathy, responsiveness, and context - not just accuracy. When effort outweighs perceived value, engagement drops quickly.

These insights reinforce the idea that financial inclusion is a journey, not a transaction. Tools like MyHisaab must evolve alongside users - from basic tracking to budgeting, saving, and eventually accessing formal financial products.

Conversational AI, when paired with empathetic design and cultural relevance, can serve as an entry point into the formal financial system - not by forcing change, but by enabling confidence.

Financial inclusion does not begin with accounts or credit. It begins when women feel safe enough to say, “This money is mine to understand.”